Now that we’re well into the new year, it’s time to start thinking seriously about our income tax filings. Even before the latest changes to the tax code, most people with deductions to claim filed their taxes each year with one question at the top of their minds: “Did I take all of the deductions I could have taken?” Depending on the monetary value of the deductions you’re eligible to take, you might see a big difference in your taxes. If you’re filing your taxes on your own, you may not be aware of all of the deductions you can take. That can mean the difference between the government sending you a refund check or you have to write Uncle Sam a check of your own.

If income taxes are known, for one thing, it’s being complicated. There’s seemingly no end to the rules and regulations regarding what you can and can’t deduct from your tax liability, depending on your situation. Although some deductions are well-known, others may not be obvious. For example, most people know they can deduct any eligible contributions they make to their retirement accounts. However, what some may not realize is that they also may be able to deduct the interest they pay on their mortgages. Charitable contributions — such as donating a car to be sold at auction for charity — are another obvious deduction. Yet many people might be surprised to learn that they can deduct what they spend on income-generating hobbies, depending on their situations.

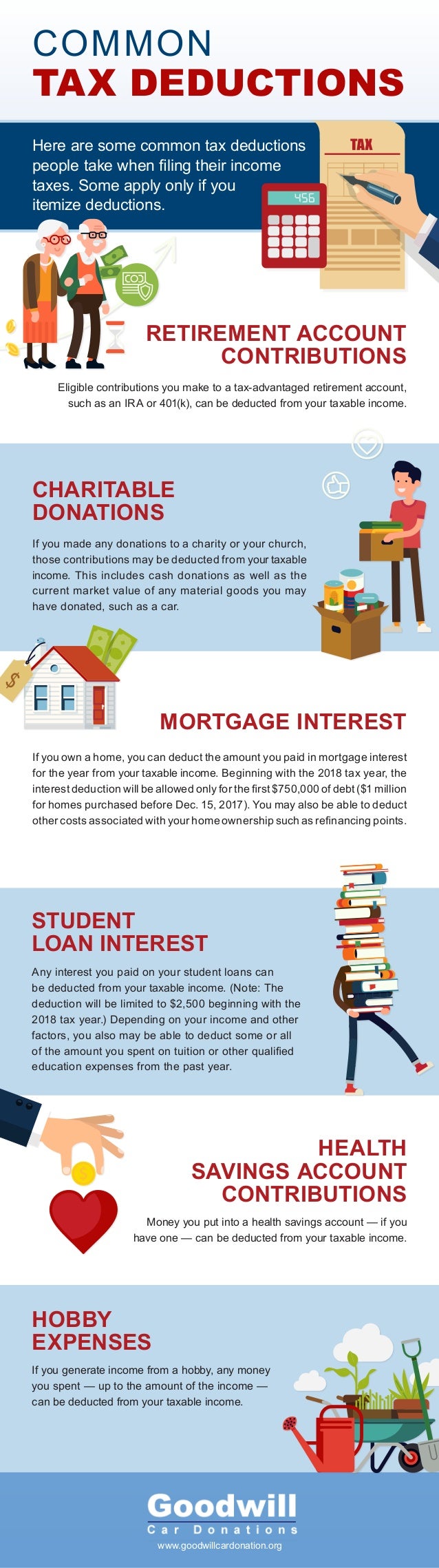

Tax time is one of the most confusing times of the year. If you don’t know everything you need to know about deductions, you might end up kicking yourself later. The accompanying infographic from Goodwill Car Donation lays out some of the most common types of tax deductions, so take a look and see if any might apply to you and your family. Whether or not you do might make a big difference in your tax returns and possibly getting a refund this year.

Connect With Me !